How To Claim CRA-approved Mileage Deductions in Canada

By A Mystery Man Writer

Last updated 18 Jun 2024

Understanding what you can and can't deduct under CRA regulations doesn't have to be difficult. Read our guide and start saving today!

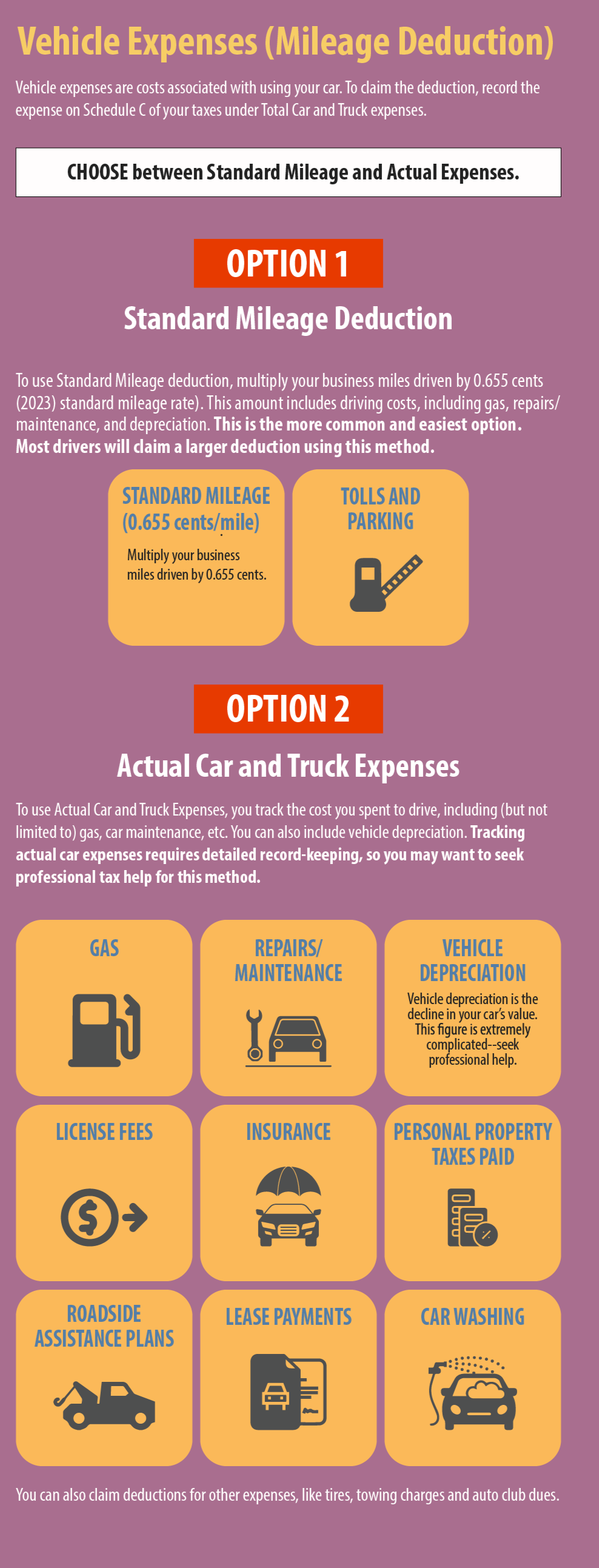

How to Claim the Standard Mileage Deduction – Get It Back

Owner-operator vs. Company Driver Taxes Explained

Remote Work Expense Reimbursement Policy Explained (2023)

Timeero - CRA Mileage Rate: A 2024 Guide - Timeero

Timeero - CRA Mileage Rate: A 2024 Guide - Timeero

How Tax Refunds Work in Canada - NerdWallet Canada

Mileage Reimbursement Explained (2023 Guide)

Manual Expense Reports: The Hidden Costs

CRA Mileage Rate in Canada 2022, 2023

How to Claim Small Business Tax Deductions

IRS Mileage Commuting Rule: What Businesses Need To Know

Recommended for you

-

Canadians Believe Canada Revenue Agency Goes Too Easy on Wealthy Tax Dodgers, Internal CRA Report Says18 Jun 2024

Canadians Believe Canada Revenue Agency Goes Too Easy on Wealthy Tax Dodgers, Internal CRA Report Says18 Jun 2024 -

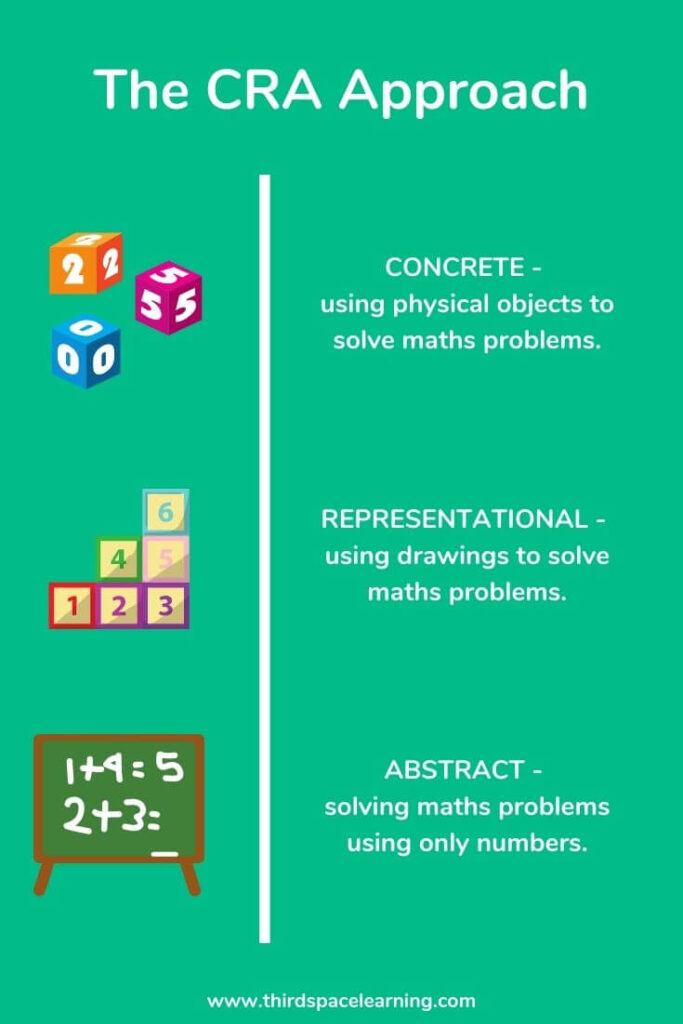

Concrete Representational Abstract: What It Is And How To Use It18 Jun 2024

Concrete Representational Abstract: What It Is And How To Use It18 Jun 2024 -

Agency to probe CRA after complaints from Muslim charities - The Globe and Mail18 Jun 2024

Agency to probe CRA after complaints from Muslim charities - The Globe and Mail18 Jun 2024 -

CRA® Body of Knowledge18 Jun 2024

CRA® Body of Knowledge18 Jun 2024 -

Very frustrating': Some taxpayers still can't access CRA accounts weeks after being locked out - National18 Jun 2024

Very frustrating': Some taxpayers still can't access CRA accounts weeks after being locked out - National18 Jun 2024 -

Cra-Z-Art 16 Count Crayon, Multicolor, Back to School18 Jun 2024

Cra-Z-Art 16 Count Crayon, Multicolor, Back to School18 Jun 2024 -

CRA Site Lawn & Land Development Inc.18 Jun 2024

-

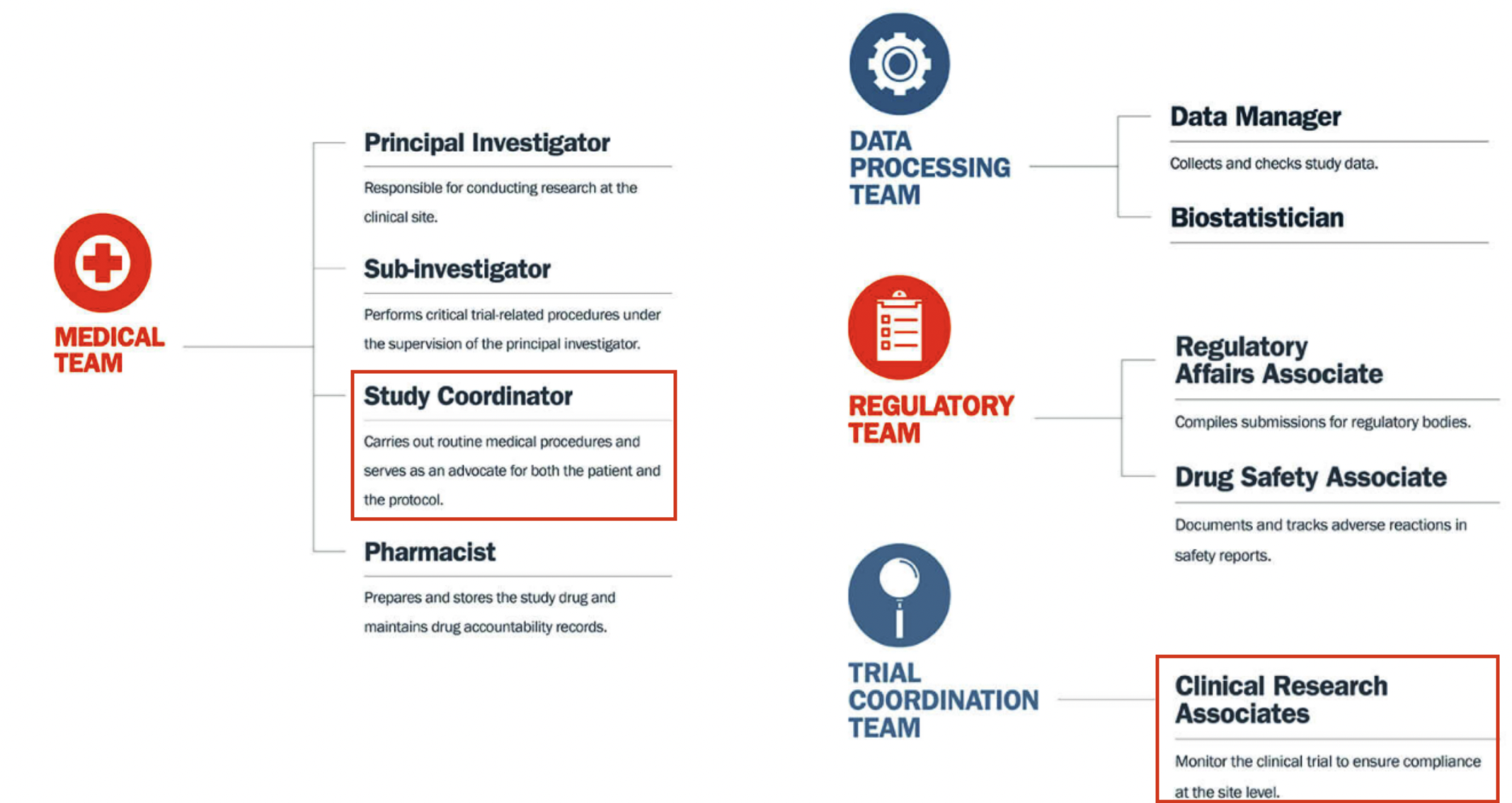

Clinical Research Associate vs Coordinator (CRA vs CRC) - CCRPS18 Jun 2024

-

Utilizing the CRA to your advantage - On-Core Bookkeeping18 Jun 2024

Utilizing the CRA to your advantage - On-Core Bookkeeping18 Jun 2024 -

Should consumer protection failures play a bigger role in CRA grades?18 Jun 2024

Should consumer protection failures play a bigger role in CRA grades?18 Jun 2024

You may also like

-

Tiger Pink Flowers - diamond Painting - DiamondByNumbers - Diamond18 Jun 2024

Tiger Pink Flowers - diamond Painting - DiamondByNumbers - Diamond18 Jun 2024 -

Hot Selling Hot-Fix Crystal Bulk Cloth Crafts Flatback Round Resin Rhinestones for Shoes Decor Bag Accessories Nail Art - China Hair Accessory and Fashion Accessory price18 Jun 2024

Hot Selling Hot-Fix Crystal Bulk Cloth Crafts Flatback Round Resin Rhinestones for Shoes Decor Bag Accessories Nail Art - China Hair Accessory and Fashion Accessory price18 Jun 2024 -

Blue Flower Print Magnetic Fireplace Cover 39x32,Decorative Fireplace Blanket Insulation Cover for Heat Loss,Indoor Fireplace Draft Stopper Covers Protectors,Farmhouse Boho Decorative Patterns : Home & Kitchen18 Jun 2024

Blue Flower Print Magnetic Fireplace Cover 39x32,Decorative Fireplace Blanket Insulation Cover for Heat Loss,Indoor Fireplace Draft Stopper Covers Protectors,Farmhouse Boho Decorative Patterns : Home & Kitchen18 Jun 2024 -

Vintage Coffee Theme Stickers Pack 40pcs – Estarcase18 Jun 2024

Vintage Coffee Theme Stickers Pack 40pcs – Estarcase18 Jun 2024 -

UHU ALL PURPOSE GLUE 60ML - NO.6 1S18 Jun 2024

UHU ALL PURPOSE GLUE 60ML - NO.6 1S18 Jun 2024 -

:max_bytes(150000):strip_icc()/re-e4cdfc685a0e409da99ffbd2a1b46230.jpg) How to Assemble and Stuff Your Wedding Invitations18 Jun 2024

How to Assemble and Stuff Your Wedding Invitations18 Jun 2024 -

DeWalt - DCE530N XR Cordless Heat Gun 18V Bare Unit18 Jun 2024

DeWalt - DCE530N XR Cordless Heat Gun 18V Bare Unit18 Jun 2024 -

M&G Ustic Strong Adhesive PVA Material 21g Office School White18 Jun 2024

M&G Ustic Strong Adhesive PVA Material 21g Office School White18 Jun 2024 -

Adult Pins – Mythical Merch18 Jun 2024

Adult Pins – Mythical Merch18 Jun 2024 -

12Pack 116 Basswood Sheets 12 x 12 Cricut Wood Thailand18 Jun 2024

12Pack 116 Basswood Sheets 12 x 12 Cricut Wood Thailand18 Jun 2024